is actblue donation tax deductible

Depending on how you donate your gift may or may not be tax deductible. Citizen or lawfully admitted.

![]()

Are My Donations Tax Deductible Actblue Support

You cannot carry forward any amount that exceeds the 300 to future tax years.

. The same goes for campaign contributions. As a service it charges a transaction fee of 395 for each donation it receives and passes along to the final recipient. Making a gift to the ACLU via a wire transfer allows you to have an immediate impact on the fight for civil liberties.

Contributions or gifts made to other organizations through ActBlue Civics are likewise not deductible. ActBlue Charities is ActBlues funding platform built specifically for 501c3 organizations which can receive tax-deductible contributions. Classification NTEE Management Technical Assistance Philanthropy Voluntarism and Grantmaking.

ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. Previously charitable contributions could only be deducted if taxpayers itemized their deductions.

Heres how the CARES Act changes deducting charitable contributions made in 2020. Specifically corporations can take up to 10 percent of their annual income in tax deductions from charitable giving. The ACLUs dual structure is not unusual.

By proceeding with this transaction you agree to ActBlues terms conditions. The IRS deems donations to eligible 501 c3 nonprofit organizations as tax-deductible. While you may think of the ACLU as one giant nonprofit the IRS does not.

Tax deductible donations are contributions of money or goods to a tax-exempt organization such as a charity. Once youre logged in you will immediately see the History page which. The ACLU actually has two arms the lobbying organization and the foundationand particularly if you itemize your taxes it pays to be aware of the difference.

At the bottom of the page it clearly states. Changing the dollar amount of your recurring donation. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.

Except that for 2020 you can deduct up to 300 per tax return of qualified cash contributions if you take the standard deduction. Charity all donations made by US. For 2021 this amount is up to 600 per tax return for those filing married filing jointly and 300 for other filing statuses.

I am a US. Also the 300 charitable. How do I change the email associated with my ActBlue Express account.

Thousands of campaigns and organizations rely on our fundraising tools which they use for no charge. However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. We pass along a 395 processing fee on contributions to the groups using our platform.

This contribution is made from my own funds and funds are not being provided to me by another person or entity for the purpose of making this contribution. Raising Money for Campaigns and Organizations. Federal income tax purposes may be.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. Because a donation is not required to enter and because CAF America is a US. Completing a contribution involves costs related to processing your credit card.

If your donation is accompanied by an experience perk the amount of your donation that is deductible for US. For Donors and Supporters. ActBlue Charities is a qualified 501 c 3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. ActBlue does not make money off of donations. It provides information about an organizations federal tax status and filings.

Donors can use it to confirm that an organization is tax-exempt and eligible to. The answer is no donations to political candidates are not tax deductible on your personal or business tax return. Contributions that exceed that amount can carry over to the next tax year.

The ACLU meets all 20 standards. I am making this contribution with my own personal credit card and not with a corporate or business credit card or a card issued to another person. Tax-Deductible Contributions for Companies.

To claim tax deductible donations. However taxpayers who dont itemize deductions may take a charitable deduction of up to 300 for cash contributions made in 2020 to qualifying organizations. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law.

The answer is no donations to political candidates are not tax deductible on your. To qualify the contribution must be. SOMERVILLE MA 02144-3132 Tax-exempt since Sept.

31 2020 to donate to a qualified charity and receive a tax deduction. Paid for by ActBlue Civics. Donors through the Omaze platform are tax-deductible to the extent allowed by law.

But because ActBlue operates as a legal conduit a federal political committee that passes contributions through to other committees it. This rule pertains to both employees and their employers. Theres just a 395 processing fee on all transactions.

Tax deductible donations can reduce taxable income. If you have an ActBlue Express account we make it easy for you to find your charitable contributions made through our platform. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law.

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Here are some key features and functions of the TEOS tool. Typically youll list any charitable donation deductions on Form 1040 Schedule A.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. You have until Dec. Taxpayers can use this tool to determine if donations they make to an organization are tax-deductible charitable contributions.

Donors can use it to confirm that an organization is tax-exempt and eligible to. Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy. Political Contributions Are Tax Deductible Like.

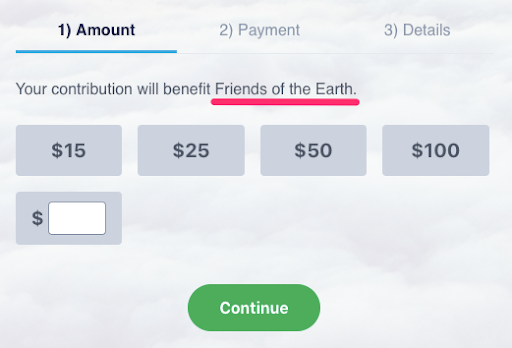

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Obama Donation Page Donation Page Web Design Landing Page

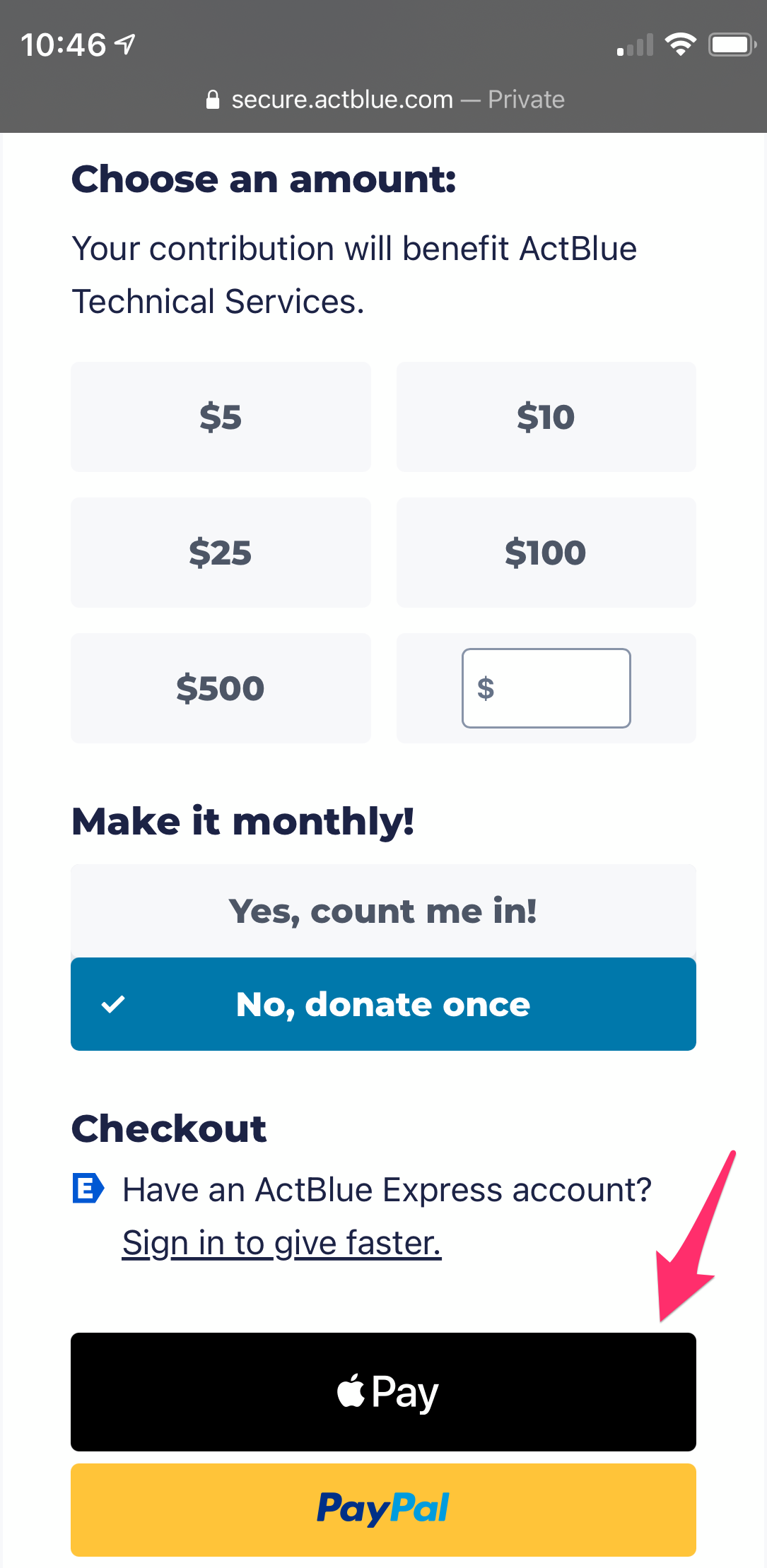

Actblue Express Lane Actblue Support

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

How Do I Use Apple Pay To Donate Actblue Support

Why Don T I See My Donation History When I Log Into My Account Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

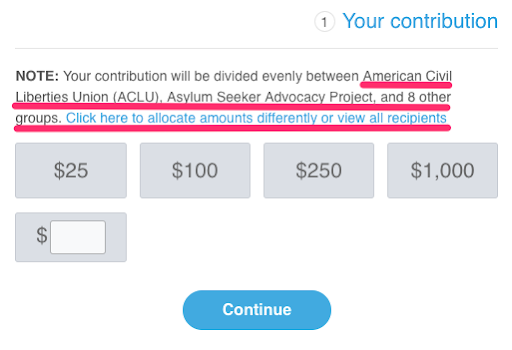

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Visit To Donate Just Received An Ad From Pinterest To Donate The Ad Disappeared But I Remember At Lea Empowerment Program Empowerment Racial Discrimination